- Home

- Home

- About us

- About us

- Services

- Fractional CFO

- Business Advisory

- Business Process Re-engineering – BPR

- Business Process Management – BPM

- Standard Operating Procedure – SOP

- Business Gap Analysis

- Mergers & Acquisitions Projections

- Feasibility Projections for Expansion Projects

- SOP Development & Implementation

- KPI Development with C-Level Monitoring

- Business Combinations

- Corporate Restructuring

- Business Planning Support

- Accounting & Bookkeeping

- Human Resource Management Services

- Employee Database

- Attendance Record Management

- Overtime & Quota Bonus payment

- Deduction, Promotion & Increments

- Bi-Annual & Annual Staff Evaluation

- KPI Development & Performance Reviews

- Compliance with Relevant Labor Laws

- End of Service Benefits Calculations

- Job Description Portfolio (JD’s)

- Training & Development

- Standard Forms & Formats Database

- Services

- CFO Services

- Business Advisory Services

- Business Process Re-engineering – BPR

- Business Process Management – BPM

- Standard Operating Procedure - SOP

- Business Gap Analysis

- Mergers & Acquisitions Projections

- Feasibility Projections for Expansion Projects

- SOP Development & Implementation

- KPI Development with C-Level Monitoring

- Business Combinations

- Corporate Restructuring

- Business Planning Support

- Accounting & Bookkeeping Services

- HR & Payroll Services

- Employee Data base

- Attendance record Management

- Overtime & Quota Bonus payment

- Deduction, Promotion & Increments

- Bi-Annual & Annual Staff Evaluation

- KPI Development & Performance Review

- Compliance with relevant Labor Laws

- End of Service Benefits

- Job Description Portfolio (JD's)

- Training and Development

- Standard Forms & Formats Database

- Clients

- Blog

- Clients

- Contact us

- Blog

- Contact us

Investment Dashboard

What is an Investment Dashboard?

Investment dashboard is an integrated panel for tracking, reconsidering, and scaling the performance of investments of the organization. This panel allows the monitoring of investment records following fixed and variable incomes. The process is administrated by an organization’s finance department under the Chief Financial Officer’s(CFO) guidance. Investment dashboard services summarize investment records. These services are given by the advisory and consulting firm.

Organizations that sell customized planning services often offer simple investment dashboards to engage their users. The reason the dashboard is a must-have is its hypercritical use for modern investors.

What do you look for in an investment dashboard?

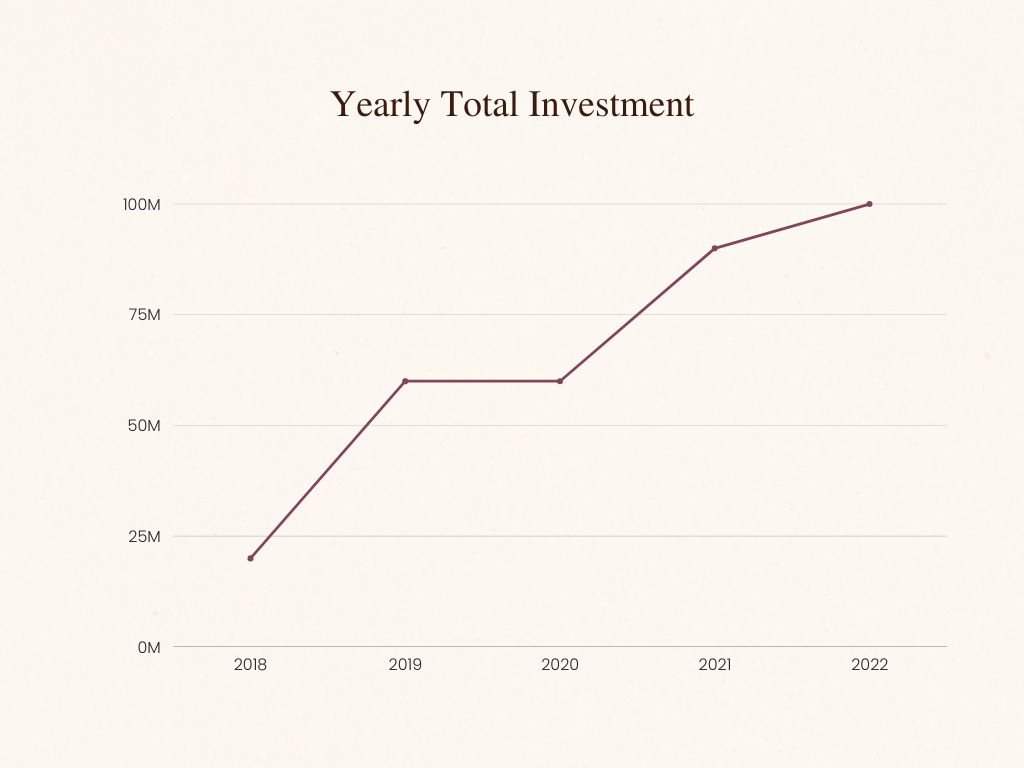

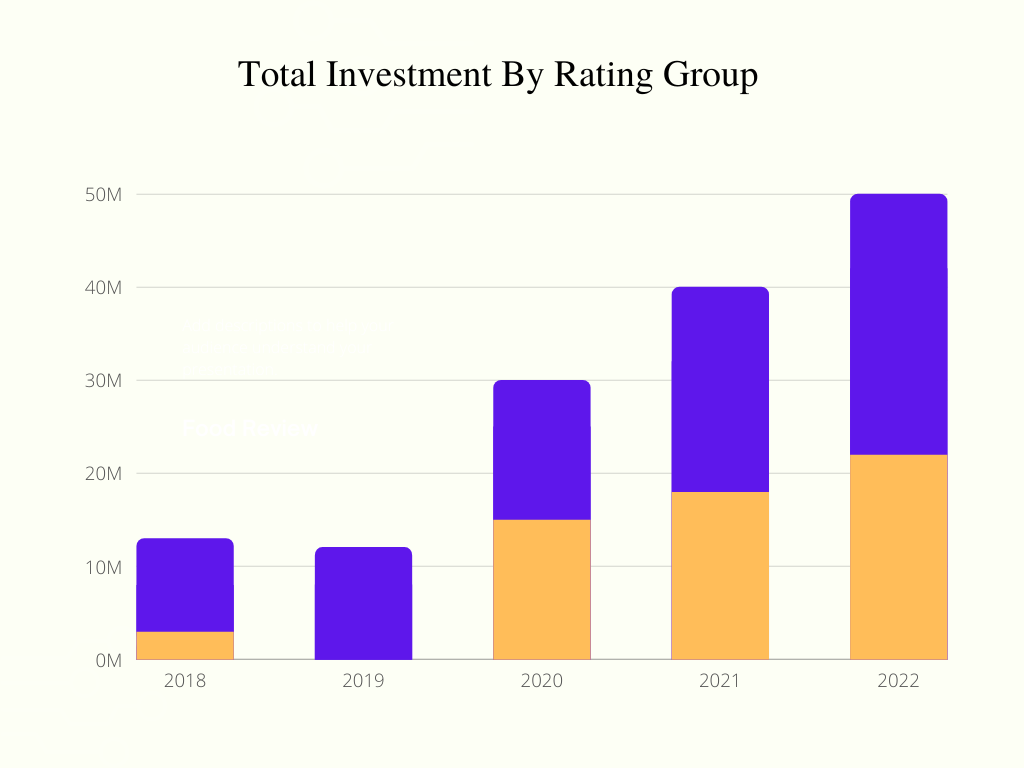

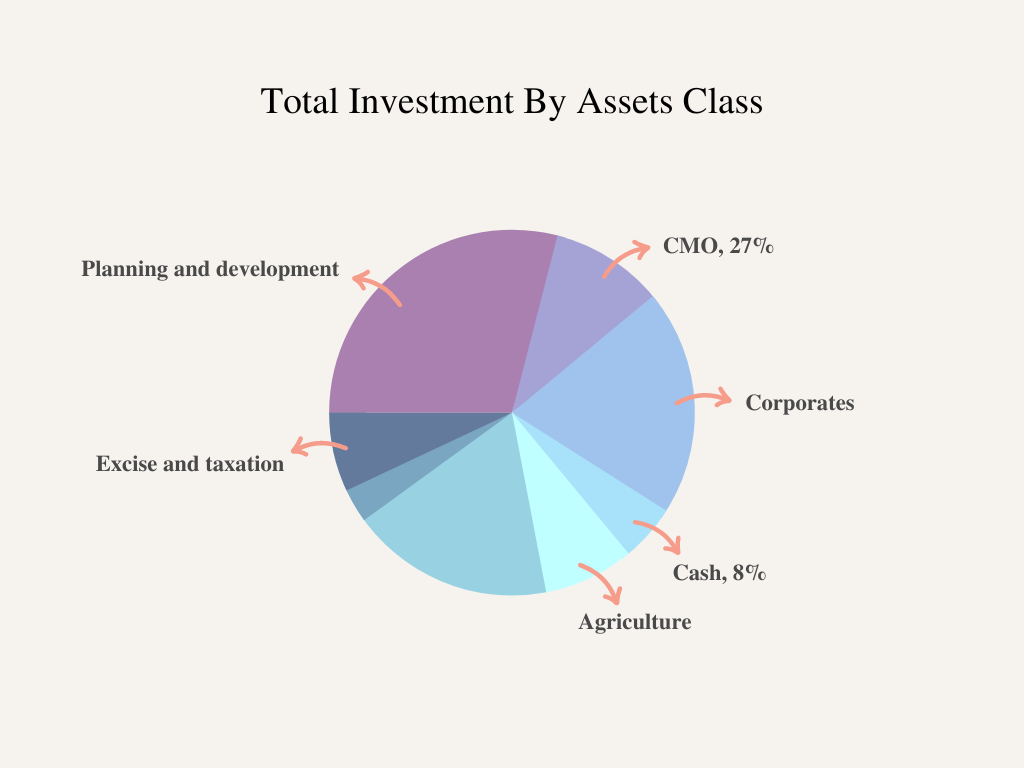

Yearly investment trends, division of asset classes, and investment concentration are some important things that are available in this dashboard.

Why does it matter?

This dashboard assists the financial department in analysis and decision-making regarding the organization’s future short and long-term goals. It provides insight into how your assets play a role in impacting your company’s net worth. A clear viewpoint of investment is necessary to set more accurate goals.

Get a conception of financial life and portfolio variation:

A key goal of the dashboard is to make your investments, accounts, and other asset types visible and reachable. Any asset bringing down your progress will be spotted and cleared out when you have a transparent portfolio.

Get more precise goals and forecasts:

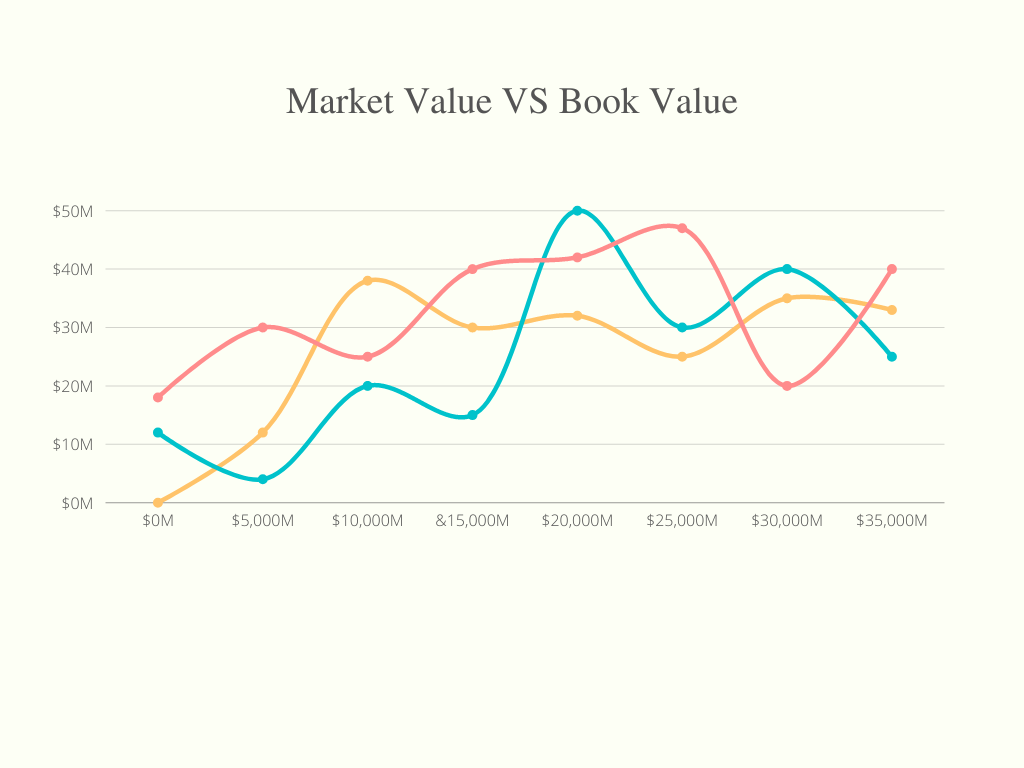

A clear view of your investments and assets is key to understanding individual and overall asset performance. you will be prepared to create more accurate reports, build out forecasts, and set achievable future goals once you have a realistic understanding of performance.

Is the investment dashboard necessary only for the financial department?

This dashboard is not only for the financial department but other departments within the company can also use the dashboard for business such as the sales department.

The key measure of organizational investment

Return on investment(ROI) is a key measure of an organization’s investment performance. Return on investment is a performance measure of a company’s profitability of the investment. It is measured by dividing net income divided by the capital cost of investment and the investment dashboard allows for measuring return on investment(ROI). The higher ratio of ROI means that a greater benefit is earned.

What does the dashboard summarize?

The dashboard summarizes total holdings, potential profits, rate of return, and daily gains or losses.

Uses of investment dashboard

There are many applications, here I would like to describe a few.

1. Check the dashboard for your intended investment company before you make decisions regarding investment. Value the operation status of your investment target using the dashboard.

2. After making investment actions, use the dashboard to keep track of up-to-date investment conditions. If the investment situation is good, you can continue to invest. Otherwise, stop investing, it is a loss of time. Make your investment strategy again.

3. Almost all departments within the company can use an investment dashboard for relevant business.

How to create a dashboard?

Here are key points for building an investor dashboard that helps to visualize the assets impacting your net worth performance.

1. Round up all accounts and assets

First, account for all your assets and liabilities that make your portfolio and affect your net worth. Assets may include cryptocurrencies, valuables, vehicles, real estate, cash, and stock accounts. In this process, this is the point where you use pencil and paper to track everything you own and owe.

2. Set your preferred currency

Next up, choose the preferred currency in which you like to see your portfolio.

3. Identify return on various investments

The internal rate of return calculator IRR is a detailed version of ROI that includes cash flow and holding time. Take advantage of it. Make sure all your assets are up to date.

4. View assets allocation and track net worth

Give a detailed view of asset allocation, asset performance, and net worth change over time using beautiful charts and graphs.

Developing Software in the Market

Several high-quality software are available in the market that aid in developing the best dashboards such as;

- QlikView

- KPI Dashboard

- CMO Dashboard

- Marketing Contribution Dashboard

- PowerBI

- Tableau

- Zoho Analytics

- FineReport

Golden Rule of Investing:

“The greater the potential returns, the higher the level of risk”

You May Also Like

Business Gap Analysis

The term Chief Financial Officer (CFO) is a senior executive responsible for managing the financial operations of a company. The CFO’s duties include tracking cash flow and financial planning as well as analyzing the company’s financial strengths and weaknesses and suggesting improvements...

Role Of Chief Financial Officer (CFO)

The term Chief Financial Officer (CFO) is a senior executive responsible for managing the financial operations of a company. The CFO’s duties include tracking cash flow and financial planning as well as analyzing the company’s financial strengths...

Standard Operating Procedures (SOPs)

A Standard Operating Procedure (SOP) is a set of written instructions that describes activities necessary to complete the task under industry regulations. A Standard Operating Procedure is a document containing step-by-step instructions. SOP means simply a step-by-step production line procedure...

Managing Business Through Finance

Managing a business through finance is one of the most crucial aspects of any organization. It is important to make sure that the financial resources are utilized in the best possible way to ensure the success and growth of the business. The management of finances is a multi-step process...