Treasury Management

What is treasury management?

Treasury management is the process of managing a company’s daily cash flows and larger-scale decisions made when it comes to finances. It is a key component of business operations. In the business landscape, the importance of treasury management cannot be denied. Treasury management services simplify business finance. It manages cash and investments, establishes and maintains credit lines optimizes investment returns and other financial assets. In fact, it is the overall management of business holdings. The process is administrated by an organization’s finance department under the Chief Financial Officer’s (CFO) guidance.

Difference between treasury and finance

The main difference between treasury and finance is the domain and timeline of their roles in the enterprise. Treasury management focuses on short-term goals while finance focuses on long-term goals. It includes the periodic examination of income and expense budgets while financial management includes the preparation and presentation of financial statements.

The primary goal of treasury management

The supreme goal of TM is to enhance financial liquidity and minimize risk. It ensures that the business always has the access to use surplus cash efficiently. For any company to strive financially, managing its money effectively is important. Even the rigorous TM systems make clear that they can optimize cash flow.

How much does a TMS cost?

The cost of a TMS depends on the features and functionality required by the business. It is important to select a system that meets the specific needs of the business.

Main areas of treasury management

Treasuries are caretakers of business cash and regulate through:

- The amount held

- Liquidity

The sheer size of the balance sheet and relative stickiness are its two main levers. TM processes can vary from company to company but the majority of them determine the design process for operations and procedures.

Benefits of treasury management

Fraud and risk management are two important concerns as your business grows. Following are the key benefits of treasury management.

1. Time efficiency:

By reducing hours spent on authorization, time can be saved.

2. Cost saving:

Using TM tools and resources to locate the cost of bank transactions helps businesses check where they might pursue additional fees.

3. Cash visibility and forecasting:

Cash visibility and forecasting allow you to make positive decisions and gain control over financial processes which reduces costly errors.

4. Fraud protection:

It protects you against fraud and infringements. With treasury services, owners can see suspicious activities happening in the company.

5. Encourages financial growth:

TM is an effective tool that helps you to generate more wealth and increase the profit ratio. Greater financial growth ensures that the company has more money to pay its employees.

Treasury Management Services

Outsourced treasury services help corporate treasurers in achieving strategic goals. Here is a list of TM services offered by an advisory and consulting firm.

Setting up a treasury function

TM experts design and execute a management system that results in reduced borrowing, hedging, and a reduction in bank transaction costs.

Treasury consulting

A team of external treasures works with the organization to advise on treasury matters. They develop strategies for financial risk management, liquidity, and cash management.

Transaction-related treasury advice

The external treasury advisors assist in locating and handling financial risk in a financial advisory transaction. The advisors assist

Buyers

Post-acquisition

Companies that are refinancing debt

Businesses that are experiencing restructuring challenges

Treasure optimization

The treasury management service providers help to find where the organization’s treasury function falls. The current state of the treasury team may be fragmented, controlled, or optimized.

Payments and FX

Payments and FX capabilities of treasury services experts can optimize the organization’s cross-currency treasury potential. It is done through global formatting guides that provide up-to-date requirements to facilitate properly formatted payments.

FX risk management

Foreign exchange risk is the most common type of risk that treasures solve. These services include identifying the risk by gathering underlying exposures from cash flow forecasts.

Liquidity management

All treasures need solutions to optimize liquidity and working capital. liquid management services help the treasury team to tackle challenges that help to optimize cash flow. It also lowers the risk of focusing on process automation and custom structures.

Receivables management

This service provides capability at each step of the receivable process and works in conjunction with the treasury team. It reduces the days’ sales outstanding(DSO) and improves working capital.

Extended services include;

- Treasury research

- Industry benchmark studies

- Advisory services

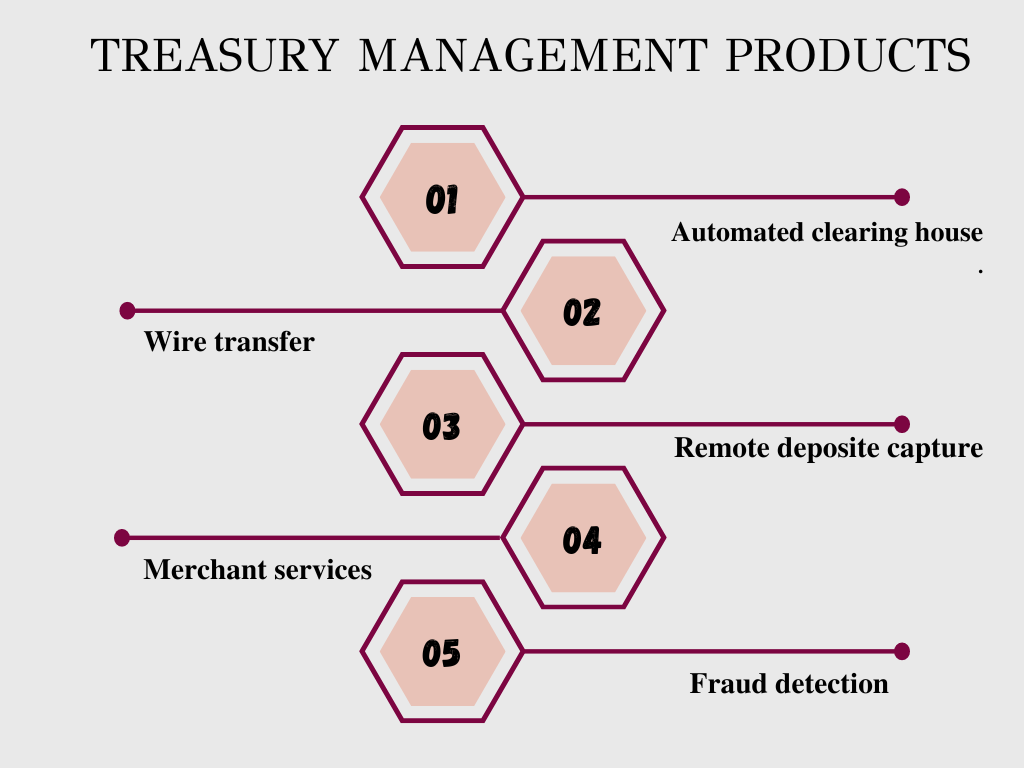

Treasury management products

Here are the essential treasury management products

- Automated clearing house

- Wire transfer

- Remote deposit capture

- Merchant services

- Fraud detection

Risks of not using TM services

Businesses that do not use TM services are at greater risk of a financial crisis. Poor cash flow forecasting leads to liquidity problems. The failure to pay bills on time results in damage to a business crisis. It helps to improve cash flow forecasting, reduce cost and better manage treasury processes.

Yoy May Also Like

Investment Dashboard

The investment dashboard is an integrated panel for tracking, reconsidering, and scaling the performance of investments of the organization. This panel allows the monitoring of investment records following fixed and variable incomes. The process is administrated by...

Cost Optimization

The ongoing process of locating and eliminating the sources of wasteful spending, underutilization, or poor return is known as cost optimization. While reinvesting in new technology to boost company growth or increase margins, the practice aims to lower costs. Cost optimization aims to coordinate service delivery...

Feasibility of Expansion Projects

Any business’s growth and development are facilitated by expansion projects. They can aid companies in boosting sales, earnings, and market share. Yet, starting an expansion project can be hazardous and expensive, so organizations should consider its viability...

Mergers and Acquisitions

Mergers and acquisitions (M&A) are business consolidations. Mergers are the merger of two companies to form one, whereas Acquisitions are the acquisition of one company by another. M&A is a significant aspect of the corporate finance world. The general...